特拉華州公司的年度特許經(jīng)營(yíng)稅是多少?

TeeVa - 協(xié)橋 - 吳衛(wèi)宏

贊同來(lái)自: foress80 、gzzong 、wowfa 、sharma 、tiffinya 、 、更多 ?

特拉華州有限公司須于每年三月一日前繳交年度特許經(jīng)營(yíng)稅,而有限責(zé)任公司則須于每年六月一日前繳交。持標(biāo)準(zhǔn)最低股本的有限公司每年須繳付特許經(jīng)營(yíng)稅最少 75美元,另加年度特許經(jīng)營(yíng)稅報(bào)告存盤費(fèi)用 50美元。有限責(zé)任公司的特許經(jīng)營(yíng)稅為 250美元。

官方資料:

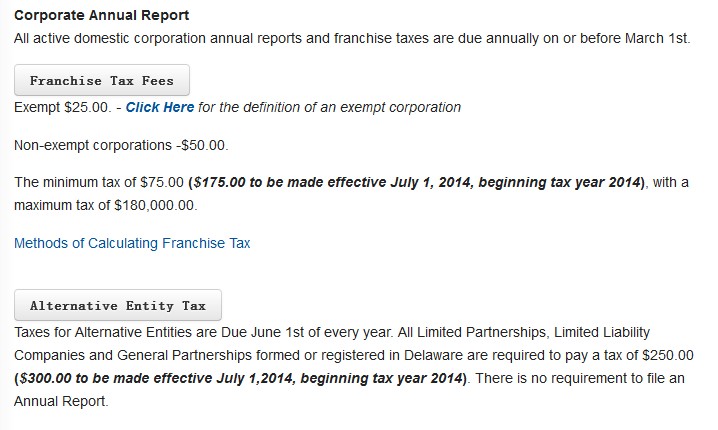

franchise tax fees

Exempt $25.00. - Click Here for the definition of an exempt corporation

Non-exempt corporations -$50.00.

The minimum tax of $75.00 ($175.00 to be made effective July 1, 2014, beginning tax year 2014), with a maximum tax of $180,000.00.

Alternative Entity Tax

Taxes for Alternative Entities are Due June 1st of every year. All Limited Partnerships, Limited Liability Companies and General Partnerships formed or registered in Delaware are required to pay a tax of $250.00 ($300.00 to be made effective July 1,2014, beginning tax year 2014). There is no requirement to file an Annual Report.

官方資料網(wǎng)站:corp.delaware.gov/paytaxes_temp.shtml